The Main Principles Of Unicorn Finance Services

Table of ContentsUnicorn Finance Services Can Be Fun For EveryoneLittle Known Facts About Unicorn Finance Services.Unicorn Finance Services for DummiesUnicorn Finance Services - An OverviewUnicorn Finance Services - QuestionsIndicators on Unicorn Finance Services You Need To Know

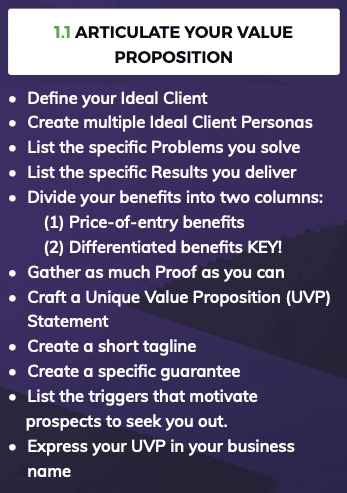

We independently review all recommended items and also services. Home mortgage brokers help prospective consumers find a lending institution with the finest terms and prices to satisfy their economic needs.

They likewise collect and also verify every one of the required documentation that the lending institution needs from the customer in order to finish the home purchase. A home loan broker normally deals with several loan providers and also can offer a range of funding choices to the consumer. A debtor does not have to work with a home loan broker.

Unicorn Finance Services Fundamentals Explained

While a home mortgage broker isn't required to promote the deal, some loan providers may only overcome home mortgage brokers. So if the lender you choose is among those, you'll require to make use of a home loan broker. A finance policeman helps a lender. They're the person that you'll take care of if you come close to a lender for a car loan.

They'll respond to all inquiries, assist a consumer get pre-qualified for a funding, and also help with the application procedure. They can be your supporter as you work to shut the funding. Mortgage brokers do not give the funds for car loans or approve car loan applications. They aid people seeking home mortgage to find a loan provider that can money their house purchase.

When conference potential brokers, get a feel for how much rate of interest they have in helping you get the car loan you require. Ask regarding their experience, the exact help that they'll provide, the fees they charge, as well as exactly how they're paid (by lender or debtor) - Mortgage brokers Melbourne.

The Basic Principles Of Unicorn Finance Services

Right here are 6 benefits of making use of a mortgage broker. Mortgage brokers are a lot more flexible with their hours and also sometimes happy to do after hrs or weekends, meeting each time as well as area that is hassle-free for you. This is a huge advantage for full time workers or households with dedications to think about when desiring to find a financial investment residential property or offering up as well as going on.

When you satisfy with a mortgage broker, you are effectively obtaining access to numerous banks and their finance options whereas a bank only has read what he said accessibility to what they are using which might not be matched to your needs. As a residential or commercial property investor, discover a knowledgeable mortgage broker who is concentrated on offering residential or commercial property investment money.

Unicorn Finance Services for Dummies

This enables it to come to be really clear of what your borrowing power truly is as well as which lending institutions are one of the most likely to offer to you. This helps you to determine which lenders your application is most likely to be successful with and decreases the opportunity that you'll be rejected various times and marks versus your debt background.

Most brokers (however not all) make money on compensations paid by the loan provider and also will entirely rely upon this, offering you their solutions cost free. Some brokers may earn a greater payment from a particular lending institution, in which they might be in favour of and lead you towards.

A good broker works with you to: Recognize your needs as well as goals. Find alternatives to suit your situation. Apply for a car loan and handle the procedure with to settlement.

Unicorn Finance Services Fundamentals Explained

Some brokers make money a basic charge no matter of what lending they suggest. Various other brokers obtain a greater fee for supplying particular finances. Sometimes, a broker will certainly charge you a charge directly rather than, or along with, the lending institution's compensation. If you're not exactly sure whether you're getting an excellent bargain, ask around or look online to see what various other brokers charge.

Browse the following checklists on ASIC Link's Professional Registers: Credit Report Agent Credit scores Licensee To look, select the checklist name in the 'Select Register' drop-down menu. If the broker isn't on among these listings, they are running unlawfully. Prior to you see a broker, assume concerning what matters most to you in a mortgage.

Make a checklist of your: 'must-haves' (can't do without) 'nice-to-haves' (can do without) See choosing a residence car loan for advice on what to think about. You can find an accredited mortgage broker through: a home mortgage broker expert association your loan provider or financial institution recommendations from individuals you recognize Bring your listing of must-haves and nice-to-haves.

Unicorn Finance Services Can Be Fun For Anyone

Obtain them to discuss just how each car loan choice works, what it sets you back and also why it remains in your benefits. You do not have to take the initial financing you're supplied. If you are not pleased with any kind of option, ask the broker to find choices. You may prefer a specific lender, such as your present financial institution - https://www.livebinders.com/b/3368714?tabid=18b6d4a9-6c41-e126-a50d-b646ad83dd5a.